Market Snapshot

Market Overview

Market Overview:

In recent years, the In-Vitro Diagnostics (IVD) sector has experienced a surge in mergers and acquisitions (M&A) within the medical devices market, with a particular focus on the Molecular Diagnostics segment. Companies are strategically enhancing their product portfolios and pipelines. IVD manufacturers are keen on acquiring early-stage Molecular Diagnostics firms with innovative technologies. Given limited product differentiation, companies with economies of scale maintain a competitive advantage through pricing strategies.

Companies in the IVD industry prioritize developing Companion Diagnostics and Molecular Diagnostics products due to their significant growth potential. Investments are also directed toward oncology diagnostics, infectious disease diagnostics, endocrinology, and neurodegenerative disorders. Strategic alliances between pharmaceutical and diagnostic firms enhance molecular-level treatment options. Emerging markets like Asia-Pacific and South America remain attractive for low-cost providers, though regulatory challenges in the United States and Europe can hinder entry. Companies with substantial cash reserves are entering the market through partnerships and acquisitions, fostering innovations across geographies. While R&D investments remain constant as a percentage of sales, larger companies focus more on M&A to acquire advanced technology.

Market Dynamics:

Recent developments include improved healthcare conditions in India and the adoption of innovative technologies, driving market growth. Challenges such as pricing pressures and limited reimbursement continue to affect the market. The introduction of new regulations aimed at reducing registration fees promises greater accessibility to high-end medical devices in India. Furthermore, a shift from the traditional four-phase clinical trial method to a streamlined two-phase approach is stimulating market growth in India.

Globally, factors such as rising incidents of infectious and chronic diseases, increased adoption of automated platforms by smaller healthcare facilities, and declining healthcare costs are driving market growth. Challenges include the affordability of high-end devices, reimbursement cuts, evolving regulatory policies in the US and Europe, a stringent regulatory framework, and a lack of product standardization. The expansion of universal healthcare schemes in Asian and South American countries, investments in healthcare infrastructure, and the development of novel drugs with diagnostic potential are contributing to global market expansion.

COVID-19 Impact:

The COVID-19 pandemic has significantly impacted the In-Vitro Diagnostics industry. Rapid diagnostic development, accelerated regulatory approvals, and enhanced distribution networks have been notable. IVD companies have partnered with government and non-governmental organizations to expedite the launch of new tests. While COVID-19 tests have experienced high demand, other diagnostic tests have seen reduced demand, impacting IVD company revenues. This impact is likely to extend beyond 2022, potentially leading to consolidation at both end-user and commercial levels.

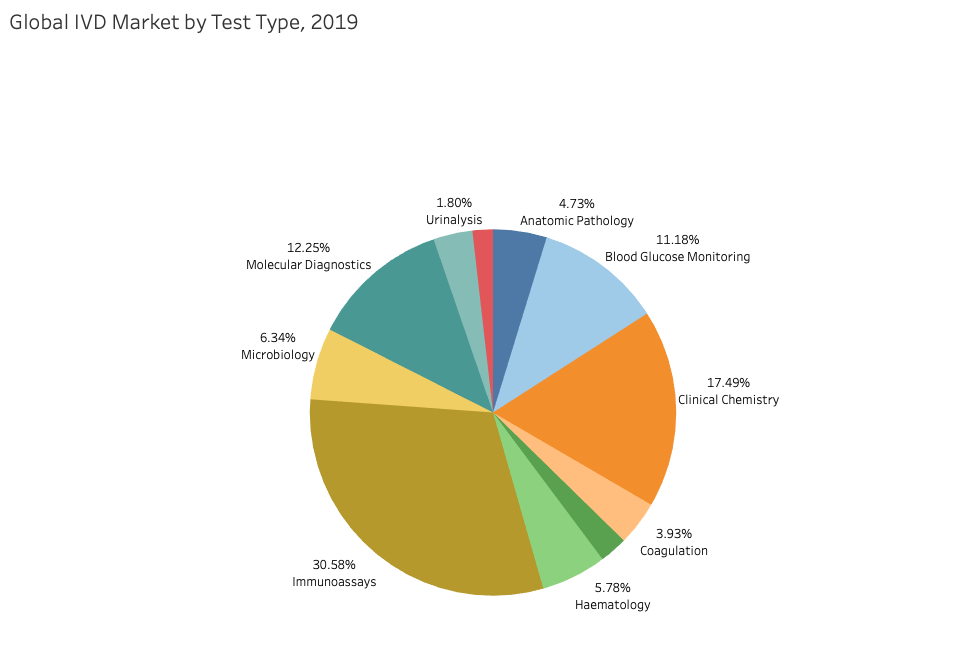

Segmentation by Test Type:

The IVD market is segmented into Immunoassays, Blood Glucose Monitoring, Clinical Chemistry, and Molecular Diagnostics, among others. Molecular diagnostics, representing over 11% of the market share in 2019, has been a rapidly growing segment. Rising disease incidence and the growth of infectious diseases have driven this segment, especially point-of-care diagnostics. Factors such as new technological platforms, unmet healthcare needs, collaborations, and growing technology investments support its growth.

Diabetes is a crucial market driver, with Blood Glucose Monitoring comprising 12% of the global IVD market. Growth is attributed to the expansion of self-blood glucose monitoring devices. The United States remains a significant market for this segment, with a higher rate of adoption in emerging markets. Companies in self-glucose monitoring devices are competing intensely on pricing. Challenges include the lack of reimbursement and the adoption of sensor-based technologies.

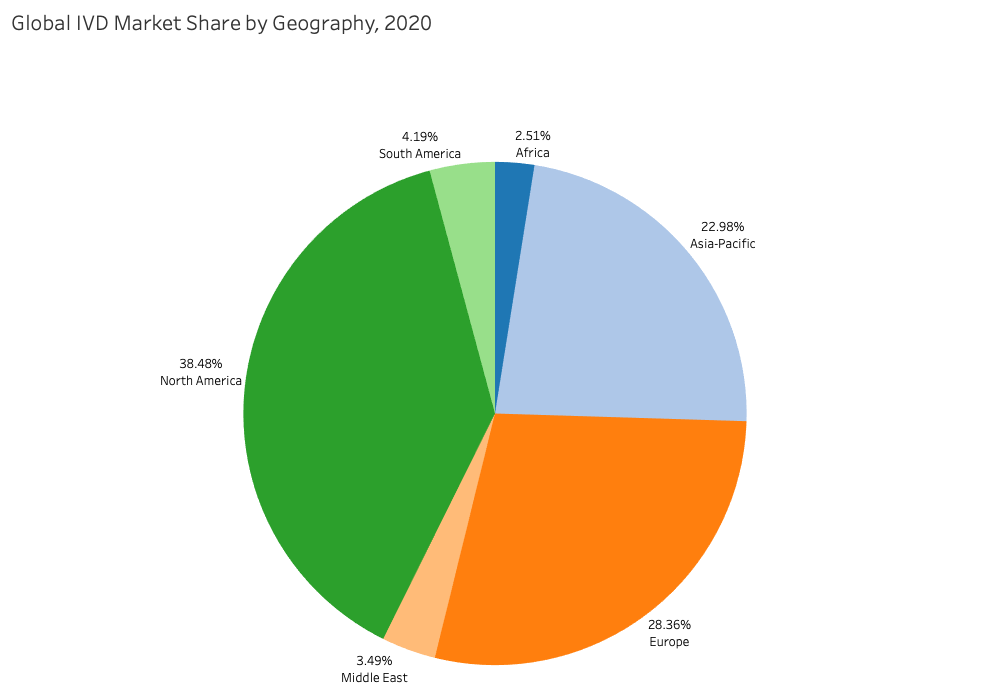

Segmentation by Geography:

The United States dominates the global IVD market with substantial revenues. However, challenges related to pricing and reimbursement persist. Changes in regulations, like the revocation of the Medical Device Excise Tax (MDET), can impact market conditions.

Europe, as the second-largest market globally, has seen growth in molecular diagnostics but sluggish growth in blood glucose monitoring. Implementation of new European IVD Regulation (IVDR) has introduced stricter safety and performance standards, but the transition process poses challenges.

The Asia-Pacific market is driven by the growth of the Chinese and Japanese markets. Asia's outpacing of global market growth is supported by the strong growth of Immunoassays and Molecular Diagnostics. Large companies dominate multispecialty hospitals, while smaller firms target mid-level hospitals. China's IVD market is consolidating through increased M&A activity.

Competitive Landscape:

The IVD market is highly consolidated, with the top 10 companies accounting for a significant market share. Companies such as Roche, Abbott Laboratories, Danaher, and Siemens are key players. While some may experience slight changes in market share, they are intensively investing in R&D and expanding into new markets. Customized solutions and IT Data Management offerings are crucial. The molecular diagnostics sector remains active in M&A activities. The market continues to attract low-cost providers in developing nations.

Porter 5

Market Segmentation

Company Performance

.png)

Financial values in the chart are available after report is purchased.

Our Company Coverage

Our comprehensive company performance report offers a detailed analysis of critical factors for our clients' industry insights. It covers key financial metrics, such as revenue, profit, and profit margin, providing a clear financial overview. We also assess the company's structure by identifying key subsidiaries and top industry competitors, conducting a thorough SWOT analysis to reveal strengths, weaknesses, opportunities, and threats. The report includes an in-depth income statement for financial assessment and a credit analysis for evaluating creditworthiness. Industry-specific data and benchmarks enable clients to compare performance, providing actionable insights for strategic decisions and competitive advantages.

Corporate Information

.svg)

Corporate Information

.svg)

Depending on the size and type of the organisation we may also provide:

.svg)

.svg)

Table of Contents

Table of Contents

1. Research Methodology and Scope

2. Executive Summary

3. Impact of COVID-19 on In-Vitro Diagnostics Market

4. Market Dynamics

4.1 Drivers

4.2 Restraints

5. Competitive Landscape

5.1 Key Strategies Adopted by Major Companies

5.2 Company Share Analysis

6. In-Vitro Diagnostics Market Segmentation by Product

6.1 Instruments

6.2 Consumables

6.3 Software

7. In-Vitro Diagnostics Market Segmentation by Test Type

7.1 Immunoassay

7.2 Clinical Chemistry

7.3 Blood Glucose Monitoring

7.4 Molecular Diagnostics

7.5 Microbiology

7.6 Anatomic Pathology

7.7 Hematology

7.8 Coagulation

7.9 Critical Care

7.10 Urinalysis

7.11 Others

8. In-Vitro Diagnostics Market Segmentation by Application

8.1 Diabetes

8.2 Infectious Disease

8.3 Oncology

8.4 Cardiology

8.5 Nephrology

8.6 Autoimmune Disease

8.7 Pharmacogenomics

8.8 HIV/AIDS

8.9 Women’s Health

8.10 Other Applications

9. 8. In-Vitro Diagnostics Market Segmentation by End-User

9.1 Hospitals

9.2 Central Laboratories

9.3 Point-of-Care

9.4 Clinics

9.5 Academic Institutions

9.6 Others

10. In-Vitro Diagnostics Market by Region

10.1 North America

10.1.1 United States

10.1.2 Canada

1-.1.3 Mexico

10.2 Europe

10.2.1 United Kingdom

10.2.2 Spain

10.2.3 Italy

10.2.4 Germany

10.2.5 Russia

10.2.6 France

10.2.7 Netherlands

10.2.6 Rest of Europe

10.3 Asia-Pacific

10.3.1 China

10.3.2 India

10.3.3 Japan

10.3.4 Australia

10.3.5 South Korea

10.3.6 Rest of Asia-Pacific

10.4 South America

10.4.1 Brazil

10.4.2 Rest of South America

10.5 Middle East and Africa

10.5.1 Saudi Arabia

10.5.2 Isreal

10.5.3 UAE

10.5.4 Africa

10.5.5 Rest of Middle East and Africa

11. Company Profiles

11.1 Abbott Laboratories

11.2 Roche

11.3 Danaher Corporation

11.4 Siemens

11.5 Thermo Fisher Scientific

11.6 Sysmex

11.7 bioMérieux

11.8 Becton Dickinson and Company

11.9 Ortho Clinical Diagnostics

11.10 Exact Sciences

12. Appendix

%201.svg)

%201.png)

%201.png)

%201.png)

.png)

.png)

.png)

%201.svg)